Opinion: Stablecoins and the new fight for monetary influence

Stablecoins have quietly turned the U.S. dollar into 24/7 software. With Washington now writing a rulebook for “digital dollars,” the stakes go far beyond crypto prices. The way the U.S. regulates stablecoins could decide who sets the standards for the next phase of global finance—and who benefits from the fees, the data, and the network effects.

Why Washington’s new rulebook matters

On July 18, 2025, the United States signed the GENIUS Act into law. The statute requires payment stablecoins to be fully backed by high‑quality liquid assets, with regular public disclosures and compliance obligations that look and feel like mainstream finance. In blunt terms: if you want to issue a dollar stablecoin to Americans, you need bank‑grade reserves, transparency, and controls. Lawmakers framed it as both consumer protection and a way to protect the dollar’s reach in the digital era. ([reuters.com](https://www.reuters.com/legal/government/trump-signs-stablecoin-law-crypto-industry-aims-mainstream-adoption-2025-07-18/?utm_source=openai))

What the law changes on the ground

- Clear federal standards for backing and redemption should reduce “who can I trust?” risk for users and merchants.

- Monthly reserve reporting and supervisory oversight push issuers toward Treasuries, cash, and repos—assets that settle cleanly and can be audited.

- Wider eligibility for issuers (banks and non‑banks) opens the door for payments firms and fintechs to plug stablecoins into everyday commerce and payroll.

For crypto investors, that clarity matters. Compliance costs rise, but so does the chance that large enterprises, card networks, and banks integrate stablecoins directly into their systems. In other words, fewer gray areas and more real‑world pipes.

The dollar’s digital export

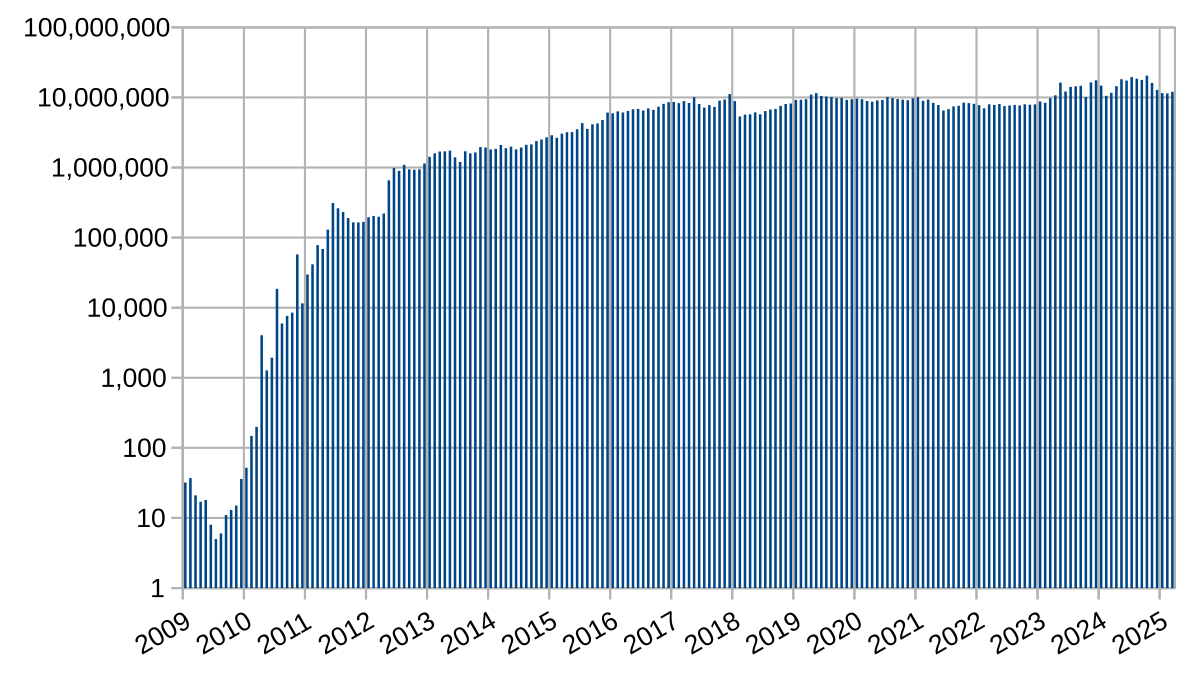

Most active stablecoins are still pegged to the U.S. dollar, and their total market value recently topped $300 billion. That makes stablecoins one of the largest digital asset categories by far and a bigger “dollar channel” than many correspondent‑banking corridors. According to coverage of DeFiLlama data, the combined stablecoin market cap crossed the $300 billion mark in October 2025. ([finance.yahoo.com](https://finance.yahoo.com/news/stablecoin-market-cap-surpasses-300-123818109.?utm_source=openai))

Utility is catching up to market value. A report cited by CryptoSlate estimated stablecoin transfers hit $27.6 trillion in 2024—outpacing Visa and Mastercard combined on transfer value. Even if a chunk of that is market‑making and arbitrage, it shows how “tokenized dollars” are becoming the default settlement asset across crypto and bleeding into commerce. ([cryptoslate.com](https://cryptoslate.com/stablecoins-surpass-visa-and-mastercard-with-27-6-trillion-transfer-volume-in-2024/?utm_source=openai))

Treasuries, reserves, and the demand loop

Rule‑driven reserves create a feedback loop. If well‑regulated issuers must hold safe, short‑dated assets, every dollar of stablecoin supply tends to pull demand toward U.S. Treasury bills and cash‑like instruments. Tether’s own disclosures showed roughly $97–98 billion of T‑bills on its balance sheet in 2024–2025, placing it among the largest non‑sovereign holders. That kind of demand can matter at the margin for funding costs and liquidity in the front end of the curve. ([investopedia.com](https://www.investopedia.com/stablecoin-issuer-tether-reports-us-treasury-stash-first-half-of-2024-8686758?utm_source=openai))

Regulated issuers such as Circle structure reserves through a registered government money market fund that holds short‑dated Treasuries and overnight repo, with daily transparency. That set‑up aligns neatly with the GENIUS Act’s push for predictable collateral, and it’s easier for banks and corporates to plug into. Circle’s public reserve page explains the approach. ([circle.com](https://www.circle.com/transparency?utm_source=openai))

Europe is building its own pipes

Across the Atlantic, MiCA—the EU’s framework for crypto assets—already applies to stablecoins (classed as e‑money tokens and asset‑referenced tokens). From June 30, 2024, issuers seeking public offering or trading in the EU must meet MiCA’s authorization and reserve requirements, with supervisors phasing in oversight and reporting. That means any “global” stablecoin strategy now has to think in terms of both U.S. law and EU e‑money rules. ([eba.europa.eu](https://www.eba.europa.eu/publications-and-media/press-releases/eba-encourages-timely-preparatory-steps-towards-application?utm_source=openai))

The euro answer: bank‑backed and regulated

In September 2025, nine major European banks—including ING, UniCredit, CaixaBank and others—announced a consortium to issue a MiCA‑compliant euro stablecoin, targeting first issuance in the second half of 2026. The plan: a supervised e‑money institution in the Netherlands and bank‑grade controls from day one. This is Europe saying, “we want our own on‑chain money, and we want it to behave like bank money.” ([ing.com](https://www.ing.com/Newsroom/News/Nine-major-European-banks-join-forces-to-issue-stablecoin.htm?utm_source=openai))

Asia’s play: licensing and CBDC‑adjacent experiments

Hong Kong passed a licensing regime for fiat‑referenced stablecoins in May 2025, with the Hong Kong Monetary Authority signaling that the first licenses are likely early next year. Several joint ventures—some involving global banks—are already queuing up. The city’s central bank is also experimenting with e‑HKD and tokenized deposits to standardize interoperability. The takeaway: Asia is not waiting for Washington or Brussels to define everything. ([reuters.com](https://www.reuters.com/world/asia-pacific/hong-kong-passes-stablecoin-bill-one-step-closer-issuance-2025-05-21/?utm_source=openai))

So who sets the standards?

All roads point to a common theme: standards will follow scale and regulatory clarity. The U.S. has the dollar and a fresh federal framework; Europe has MiCA and a bank‑led euro initiative; Hong Kong is formalizing a license path and testing wholesale use cases. The more compliant rails exist, the more corporates will route payments, trade settlement, and collateral through those rails. That’s how “digital dollars” and “digital euros” can become the default settlement layer for tokenized assets and cross‑border money.

Investor angle: what to watch next

1) Which issuers get licensed first—and where

Early U.S. permit holders under the GENIUS Act and EU‑authorized EMT issuers under MiCA will set the bar for disclosures, redemption windows, and integration with banks. Expect spreads and peg stability to track issuer quality. ([reuters.com](https://www.reuters.com/legal/government/trump-signs-stablecoin-law-crypto-industry-aims-mainstream-adoption-2025-07-18/?utm_source=openai))

2) Reserve mix and yield passthrough

With rates still meaningful, the reserve mix (T‑bills, repo, cash) drives issuer earnings. Some models share yield with users (via tokenized funds or rewards), others don’t. That can influence where wallets, exchanges, and merchants route flows. ([investopedia.com](https://www.investopedia.com/stablecoin-issuer-tether-reports-us-treasury-stash-first-half-of-2024-8686758?utm_source=openai))

3) On‑chain settlement rails

Watch where regulated dollars actually move: Solana, Ethereum L2s, and bank‑permissioned networks all compete on speed, cost, and uptime. The chain that processors and PSPs standardize on tends to win merchant acceptance.

4) Europe’s bank coin timeline

If the euro stablecoin ships on schedule in H2 2026 and plugs into treasury, custody, and core payments inside participating banks, you’ll likely see European corporates start settling invoices and securities in a native euro token—less FX slippage, tighter cutoffs. If delays stack up, dollar tokens will keep filling that role. ([ing.com](https://www.ing.com/Newsroom/News/Nine-major-European-banks-join-forces-to-issue-stablecoin.htm?utm_source=openai))

5) Asia’s licensing and CBDC pilots

Hong Kong’s first license decisions will be a signal for Singapore and others in the region. If stablecoin issuers can meet bank‑like standards and connect to tokenized deposit pilots, expect trade finance and remittances to follow quickly. ([reuters.com](https://www.reuters.com/world/asia-pacific/hong-kong-passes-stablecoin-bill-one-step-closer-issuance-2025-05-21/?utm_source=openai))

Risks that still matter

- Concentration risk: A few issuers dominate supply. One bad disclosure or a sanctions episode can ripple across markets.

- Chain outages and bridges: Payments don’t tolerate downtime. If gateways fail, merchants and payroll providers will revert to cards and wires.

- Regulatory divergence: MiCA’s treatment of multi‑jurisdiction issuance and non‑EU currency tokens is still evolving. Cross‑border fungibility could face tests as supervisors coordinate. ([reuters.com](https://www.reuters.com/markets/europe/eu-commission-investigates-depth-eu-safety-net-stablecoin-holders-2025-01-23/?utm_source=openai))

The bottom line

Stablecoins aren’t replacing the dollar; they’re extending it. The GENIUS Act gives the U.S. a chance to codify how digital dollars should be issued and redeemed, which increases the odds that American standards become the default for global rails. Europe and Asia are responding with bank‑backed coins and licensing regimes of their own. For investors, the practical moves are simple: favor regulated issuers with transparent reserves; track who wins early licenses; and follow where large PSPs, merchants, and banks actually settle on‑chain. That’s where usage—and value—tend to concentrate.

Further reading: EBA summary of MiCA’s stablecoin scope.

also read:Future of WLFI Growth Driven by Whale Accumulation and Stablecoin Expansion

Gossips2 months ago

Gossips2 months ago

Gossips2 months ago

Gossips2 months ago

Gossips2 months ago

Gossips2 months ago

Gossips2 months ago

Gossips2 months ago

NFL3 months ago

NFL3 months ago

Gossips2 months ago

Gossips2 months ago

Gossips3 months ago

Gossips3 months ago

Gossips2 months ago

Gossips2 months ago